Accounting TAX Setup in Dolibarr

To set up VAT on an accrual basis in Dolibarr, follow these steps to ensure your VAT calculations and reports align with the BIR requirements in the Philippines:

1. Enable the Accounting and Tax Modules

- Go to Home > Setup > Modules/Applications.

- Enable the Accounting module to manage VAT calculations and setup.

- Also, ensure that the Tax module is activated for defining VAT rates.

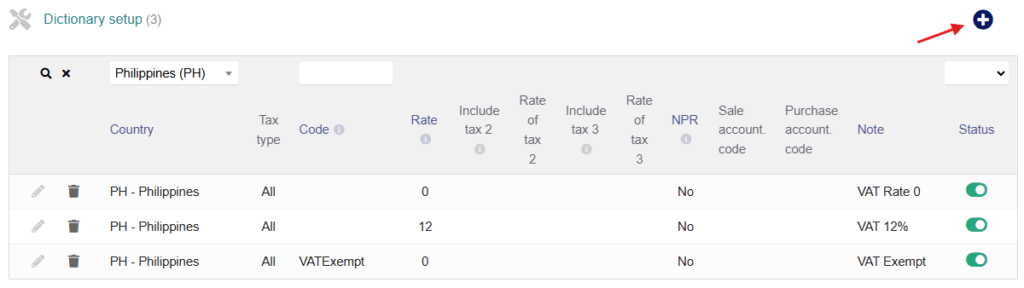

2. Set Up VAT Rates

- Go to Accounting > Setup > VAT Accounts.

- Create a new VAT rate entry for the standard VAT (typically 12% in the Philippines).

- Set the VAT rate to 12%.

- Choose the tax type as VAT.

- Label it as “Standard VAT (12%)” for easy identification.

- Add additional entries if needed, such as Zero-Rated VAT (0%) or VAT-Exempt for different transaction types.

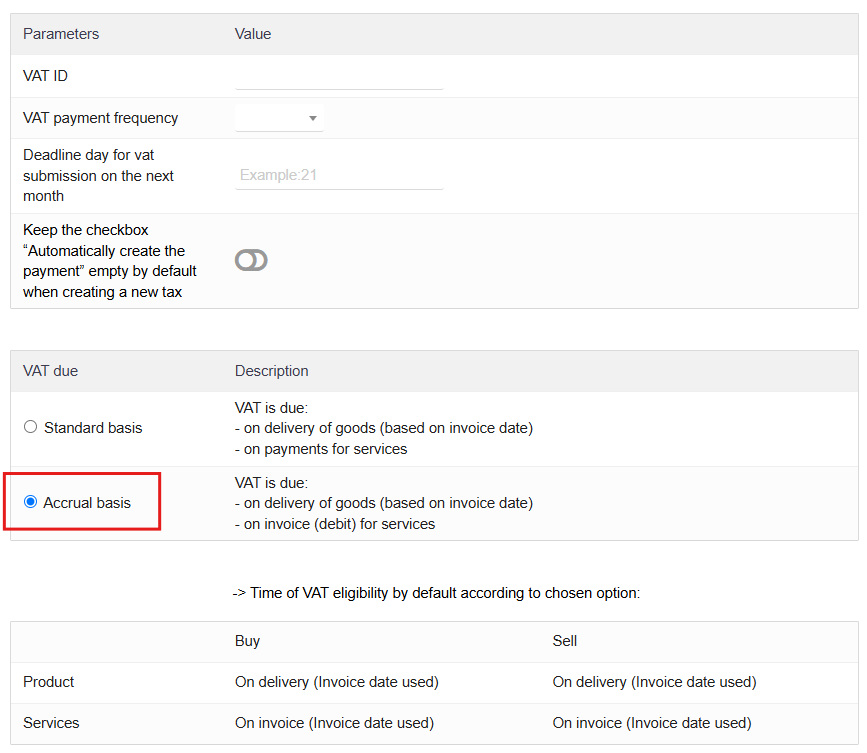

3. Configure Accrual Basis Accounting

By default, Dolibarr typically operates on an standard basis for invoices, meaning it records VAT on the date of the payment rather than invoice. You can modify TAX module to reflect this:

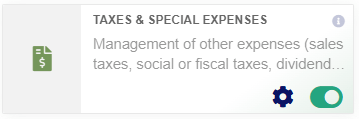

- Go to Home > Setup > Modules/Applications > TAXES & SPECIAL EXPENSES Module.

- Confirm that the VAT recording basis aligns with accrual. If Dolibarr doesn’t explicitly show this option, it will still record VAT at invoicing by default.

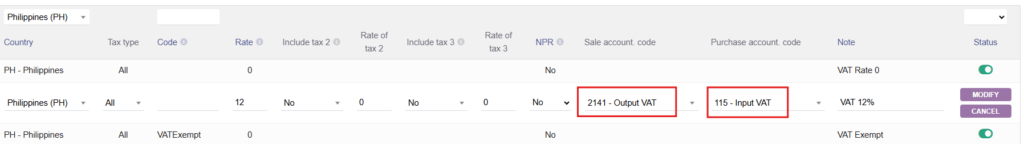

4. Define Account Linking for VAT

To ensure VAT is accurately tracked in the ledger:

- Go to Accounting > Setup > VAT Accounts and link your VAT-related accounts.

- Set up two accounts under liabilities for Output VAT and Input VAT (if not already present).

- Map the 12% VAT rate to your Output VAT account, and Input VAT rates to your Input VAT account to track VAT on purchases.

5. Invoice and Record Transactions

- When creating invoices, Dolibarr will automatically apply the VAT rate (12%) on sales and track it under the Output VAT account.

- For purchases, input VAT will be tracked under the Input VAT account when you record supplier invoices.

6. Generate VAT Reports for Filing

- Go to Accounting > Financial Reports to generate VAT-related reports on a monthly or quarterly basis for BIR filing.

- Check for any unpaid invoices, as VAT is due even on unpaid amounts when invoices are issued on an accrual basis.

This setup will help ensure Dolibarr records VAT on an accrual basis, aligning with BIR requirements and simplifying tax filing. Let me know if you need more specifics on report customization or account linkage in Dolibarr.