Setting Up Dolibarr’s Accounting Module with a USA GAAP Basic Chart of Accounts Model for Philippine Compliance

Setting up Dolibarr’s accounting module to follow Philippine Financial Reporting Standards (PFRS) can provide robust financial management and ensure regulatory compliance for businesses in the Philippines. By starting with a USA GAAP Basic Chart of Accounts (COA) model and adjusting it to fit local tax and reporting requirements, you can streamline financial tracking and reporting in line with local standards.

This guide will walk you through setting up Dolibarr’s accounting module, selecting a USA GAAP Basic COA model, and customizing it to align with PFRS.

Step 1: Enable and Configure the Accounting Module

- Log in to Dolibarr as an Administrator:

- Make sure you’re logged in with administrative rights to access module settings.

- Activate the Accounting Module:

- Go to Home > Setup > Modules/Applications.

- Find the Accounting (Double Entry) module and click on Enable to activate it.

- Configure Basic Accounting Settings:

- After enabling the module, go to Accounting > Setup > Settings.

- Configure the Accounting Year (fiscal year), Currency (select PHP for Philippine Peso), and set any VAT/Tax Rates relevant to your operations in the Philippines.

- Set the Accounting Mode to double-entry if required for more comprehensive financial tracking and reporting.

Step 2: Select and Review the USA GAAP Basic Chart of Accounts

Since Dolibarr comes pre-installed with a USA GAAP Basic COA model, you can easily select and review this model as the starting point for customization.

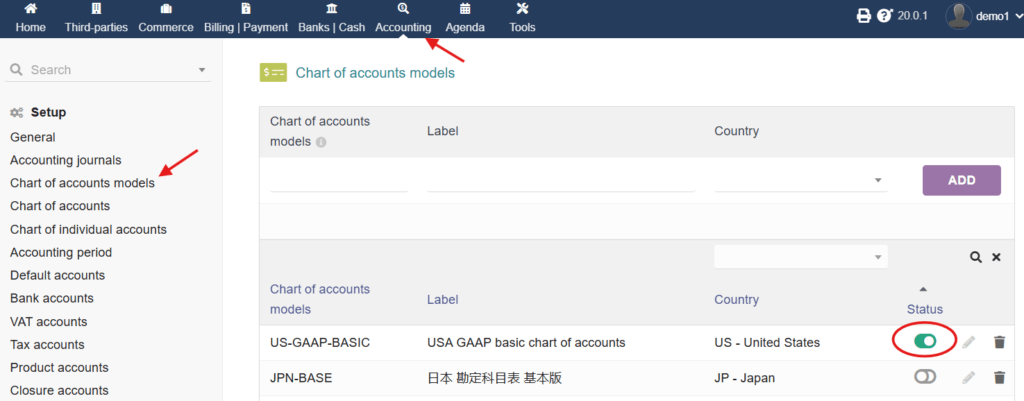

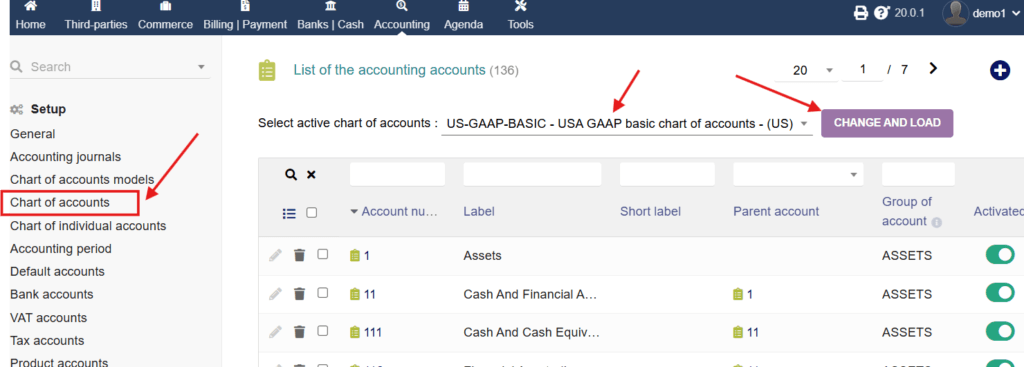

- Access the Chart of Accounts:

- Navigate to Accounting > Setup > Chart of Accounts.

- The USA GAAP basic COA model should be visible by default if Dolibarr’s standard installation was used.

- Review the Default Structure:

- Take a look at the main account categories, such as Assets (1000-1999), Liabilities (2000-2999), Equity (3000-3999), Revenues (4000-4999), and Expenses (5000-7999). Ensure these align with your business needs and the account structure you plan to use.

Step 3: Customize the Chart of Accounts to Align with Philippine Standards

After setting up a USA GAAP Basic COA, you’ll need to modify certain accounts and add others to ensure compliance with Philippine Financial Reporting Standards (PFRS) and Bureau of Internal Revenue (BIR) regulations.

- Adjust Accounts for Philippine Tax and Legal Requirements:

- Add VAT Accounts: Under Liabilities, create sub-accounts for VAT Payable and VAT Input Tax to track output and input VAT.

- Income Tax Payable: Add an account under Liabilities for Income Tax Payable to manage corporate income tax responsibilities.

- Withholding Taxes: Create accounts under Liabilities for Withholding Tax on Compensation, Expanded Withholding Tax (EWT), and any other specific taxes your business is subject to under Philippine law.

- Customize Account Codes and Hierarchies:

- If needed, adjust the COA numbering to follow the structure used by Philippine businesses (e.g., Assets starting with 1, Liabilities with 2).

- Ensure each account is logically organized for ease of tracking, especially tax-related accounts like VAT, Withholding Taxes, and Sales Discounts.

- Add Sub-Accounts for Expense Classification:

- Create sub-accounts under Operating Expenses for specific expense types required by the BIR, such as Representation and Entertainment Expense (limited for tax deduction) and Interest Expense.

- Create detailed accounts for utility expenses, salaries, office supplies, and other administrative costs to comply with PFRS reporting requirements.

- Set Up Cost of Goods Sold (COGS):

- If your business is involved in manufacturing or retail, set up accounts for Merchandise Purchases, Freight In, and Inventory Adjustments under the COGS section.

Step 4: Configure Tax Rates and VAT Handling

- Set Up Philippine-Specific Tax Rates:

- Go to Accounting > Taxes and configure standard VAT rates (e.g., 12% VAT on sales).

- Add rates for withholding taxes or any other local tax rates applicable to your business operations.

- Enable Automatic Tax Calculations:

- In Accounting > Setup > Other Options, you can enable automatic VAT calculation on sales and purchases if you want Dolibarr to automatically apply VAT to relevant transactions.

- Verify VAT Posting Accounts:

- Ensure VAT entries are mapped correctly to the appropriate accounts in the COA (e.g., VAT Payable for sales VAT and VAT Input Tax for purchases).

Step 5: Review and Test with Financial Reports

Once the COA is set up, use Dolibarr’s reporting tools to test the configuration and confirm that financial reports align with Philippine standards.

- Generate a Trial Balance:

- Go to Accounting > Financial Reports and generate a Trial Balance to verify that all accounts are set up correctly and balance.

- Run Financial Statements:

- Generate Balance Sheet and Income Statement reports to check that revenue and expense accounts are correctly categorized and that liabilities and equity balances match.

- Confirm that tax accounts (e.g., VAT and Withholding Tax) appear in the correct sections of the Balance Sheet.

- Adjust as Necessary:

- If certain accounts are missing or incorrectly mapped, go back to Accounting > Setup > Chart of Accounts and make the necessary changes.

Additional Tips for Ongoing Compliance

- Regularly Review BIR Regulations: Philippine tax regulations can change frequently, so periodically review your COA and adjust tax accounts as needed.

- Use Accounting Software with PFRS Support: Dolibarr’s flexibility with COA customization makes it easier to align with PFRS. Consider periodic consultations with a local accountant to keep your COA aligned with the latest standards.

- Automate Reports for Efficiency: Once configured, Dolibarr can automate recurring reports, saving time and ensuring consistency in financial tracking.

Conclusion

By carefully configuring Dolibarr’s Accounting module with a USA GAAP Basic COA and modifying it to meet Philippine standards, your business can achieve both regulatory compliance and efficient financial management. With periodic updates and local expert guidance, this setup can provide a robust foundation for your accounting needs.

Cirrofy has refined the ERP for Philippines setting.